Royalties

Our Royalties segments are comprised of a growing portfolio of mineral and royalty interests in strategic oil & gas producing regions of the United States as well as strategic coal reserves in the basins in which we operate.

We market our oil & gas mineral interests for lease to major operators in those regions and generate royalty income from the leasing and development of those mineral interests, and generate coal royalty income from mineral resources we own and lease to our coal mining operations.

Oil & Gas Royalties

As part of our strategy to diversify and evolve with the needs of the U.S. energy industry, since 2014 we have developed and scaled a leading oil & gas minerals platform. We market our oil & gas mineral interests for lease to operators in those regions and generate royalty income from the leasing and development of those mineral interests.

Our Portfolio:

- Approximately $730 million invested since 2014, and $447 million net of cumulative Segment Adjusted EBITDA

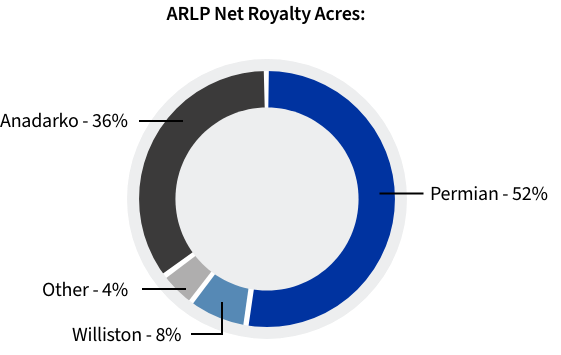

- ~68,578 net royalty acres in premier oil & gas producing regions

- 3.1 million barrels of oil equivalent produced by lessees in 2023

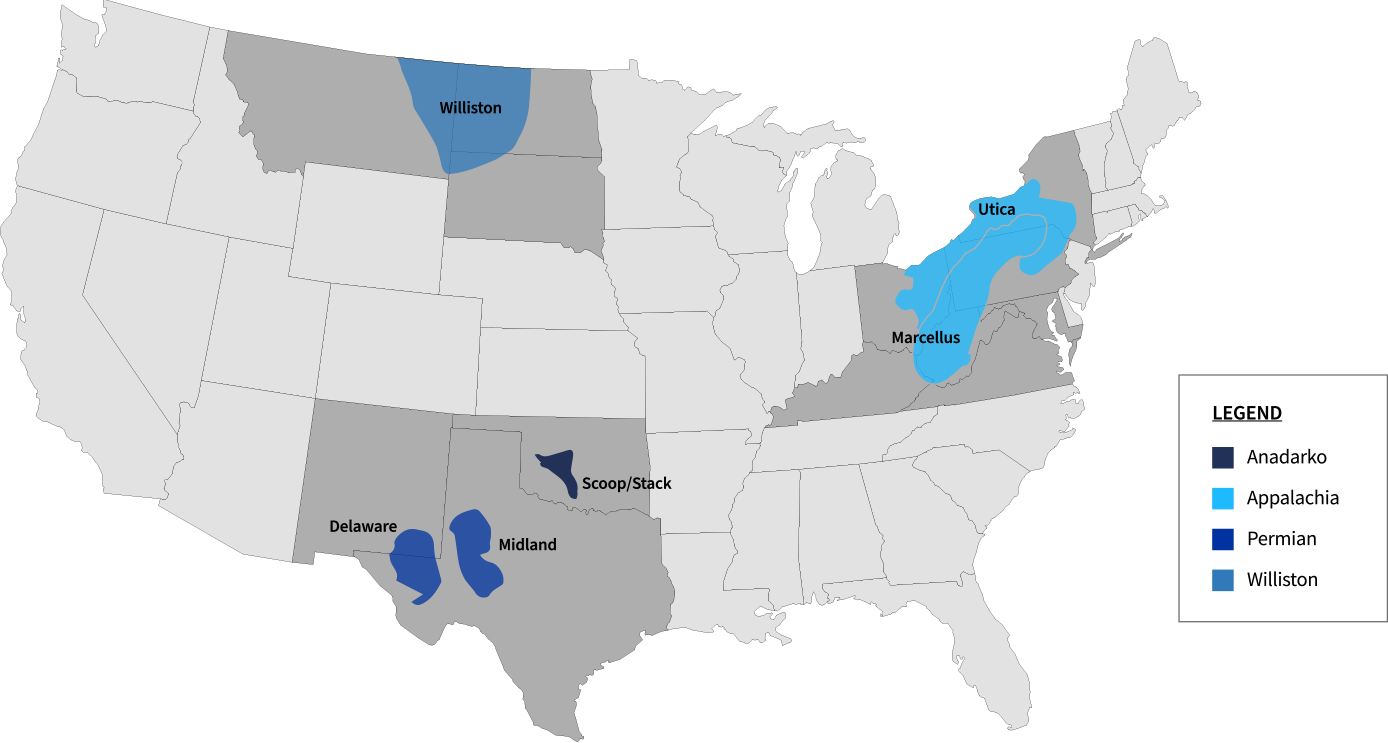

- Concentrated exposure to the Permian Basin, the most prolific in the U.S.

- Additional exposure in the Anadarko, Williston and Appalachian basins

Our Oil & Gas business is positioned for sustainable, self-funded growth with plans to reinvest organic free cash flow. We look to grow through two primary mechanisms:

- Selective acquisition strategy targeting scaled asset packages and highly-fragmented ground game mineral interests with outsized returns relative to acquisition economics

- Organically with no additional investment required from our royalty interests concentrated in core acreage positions of well-capitalized operators with multi-decades of new well inventory

Oil & Gas Royalty Asset Overview:

The following table summarizes the production and reserves of our oil & gas mineral interests for the year ended December 31, 2023.

Oil & Gas Royalties | Production | Proved Reserves |

Oil (MBbls) | 1,418 | 7,754 |

Natural Gas (MMcf) | 5,759 | 45,684 |

Natural Gas Liquids (MBbls) | 726 | 5,485 |

BOE (MBBls)* | 3,105 | 20,294 |

*Natural gas reserve volumes are converted to BOE based on a 6:1 ratio: 6 Mcf of natural gas converts to one BOE.

Coal Royalties

Our Coal Royalties segment includes:

- Approximately 663.2 million tons of proven and probable reserves

- Substantially all of the 1.07 billion tons of our measured, indicated and inferred coal mineral reserves and resources

Our coal mineral reserves and resources are owned by our wholly-owned subsidiary, Alliance Resource Properties, and are located in the Appalachia and Illinois Basins of the United States. We lease our reserves and resources to our mining complexes under long-term leases. Approximately two-thirds of our royalty-based leases have initial terms of five to 40 years, with substantially all lessees having the option to extend the lease for additional terms.

Under our standard royalty lease, we grant the lessees the right to mine and sell our reserves and resources in exchange for royalty payments based on a percentage of the sale price or a fixed royalty per ton of coal mined and sold. Lessees calculate royalty payments due to us and are required to report tons of coal mined and sold as well as the sales prices of the extracted coal.

The following table summarizes the coal sales associated with our coal mineral interests for the years ended December 31, 2023.

Coal Royalties | Production | Proven and Probable | Measured, Indicated and Inferred Resources Year Ended 12/31/23 |

Illinois Basin (MM tons) | 19.9 | 477.0 | 977.2 |

Appalachia (MM tons) | 0.3 | 80.7 | 85.4 |

Total (MM tons) | 20.2 | 557.7 | 1062.6 |